Telephone calls and online chat conversations may be recorded and monitored.

EMA FORMULA REGISTRATION

CMC Markets UK Plc and CMC Spreadbet plc are registered in the Register of Companies of the Financial Conduct Authority under registration numbers 173727. CMC Markets Germany GmbH is a company licensed and regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) under registration number 154814. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.ĬMC Markets is, depending on the context, a reference to CMC Markets Germany GmbH, CMC Markets UK plc or CMC Spreadbet plc. 77% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. By interpreting trendlines based on historical data, traders may make decisions based upon the conclusion that the trend will repeat itself. Furthermore, the EMA can also be prone to false signals, such as false positives and false negatives, meaning that it could mislead traders. However, a key drawback of the exponential moving average is that it is based on historical data, so it cannot predict future price movements. When the EMA is rising, it is supporting the price action, while the falling EMA is providing resistance to positive price action. This is because support and resistance levels are dynamic and constantly evolving, due to the fact that they’re based on more recent price action. The EMA can be an indicator for support and resistance levels. On the other hand, when the EMA is falling, traders may choose to sell when the price is rallying towards, or just above the EMA.

When a trader is using an exponential moving average indicator within their strategy, they may choose to buy when the price dips near, or just below, the EMA line. Therefore, developing an exponential moving average strategy is great for traders who favour short-term strategies, such as day trading in fast-moving markets.

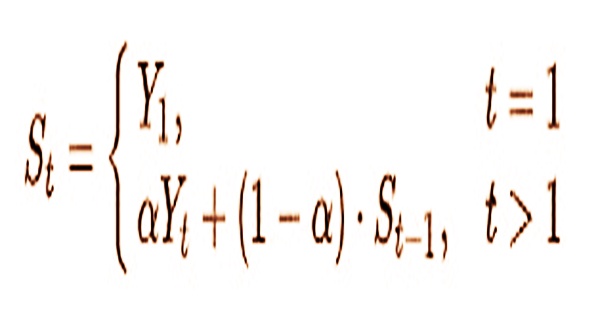

It also means that there is less of a lag, as the EMA instead reacts quickly to price changes. It is particularly useful for identifying trends and recent swings on price charts to highlight trading patterns. This higher weight of recent price data is useful when analysing volatile markets, where there may be abrupt price changes. The exponential moving average therefore helps to influence traders’ decisions in the exact moment that they place a trade based on the exact price movements, as opposed to what was happening on trading charts in the past. As more weight is given to the recent price data and less to that which occurred earlier in the trading day, this makes it more sensitive to any change in price data and, theoretically, better for understanding in which direction the price may head next.

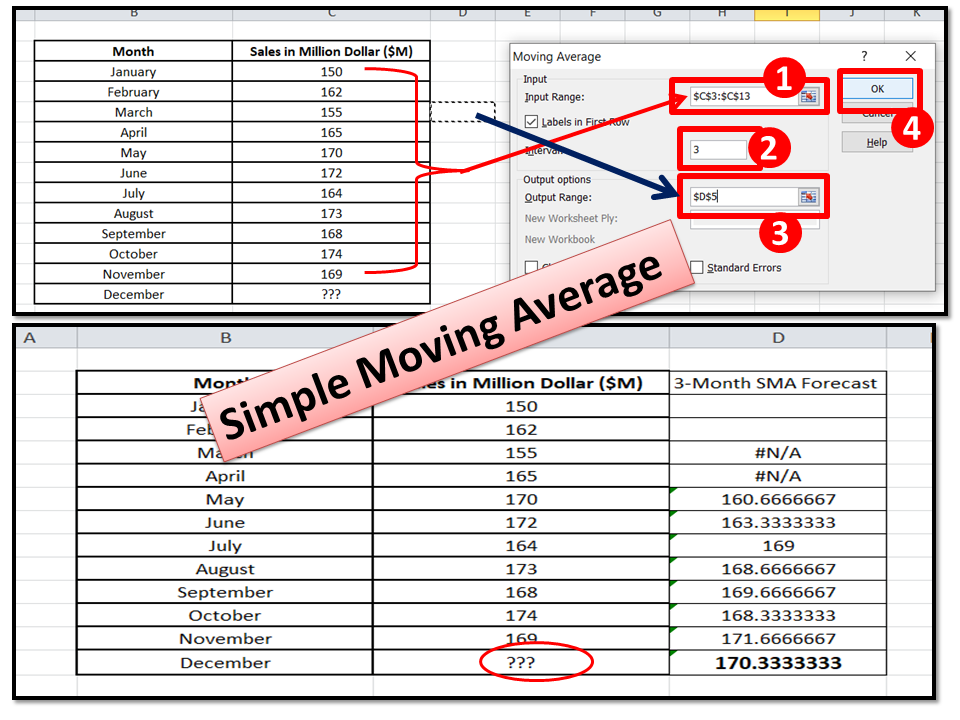

Using the EMA in trading means that it adapts more quickly to changes in price action, which is an advantage over the simple moving average.

0 kommentar(er)

0 kommentar(er)